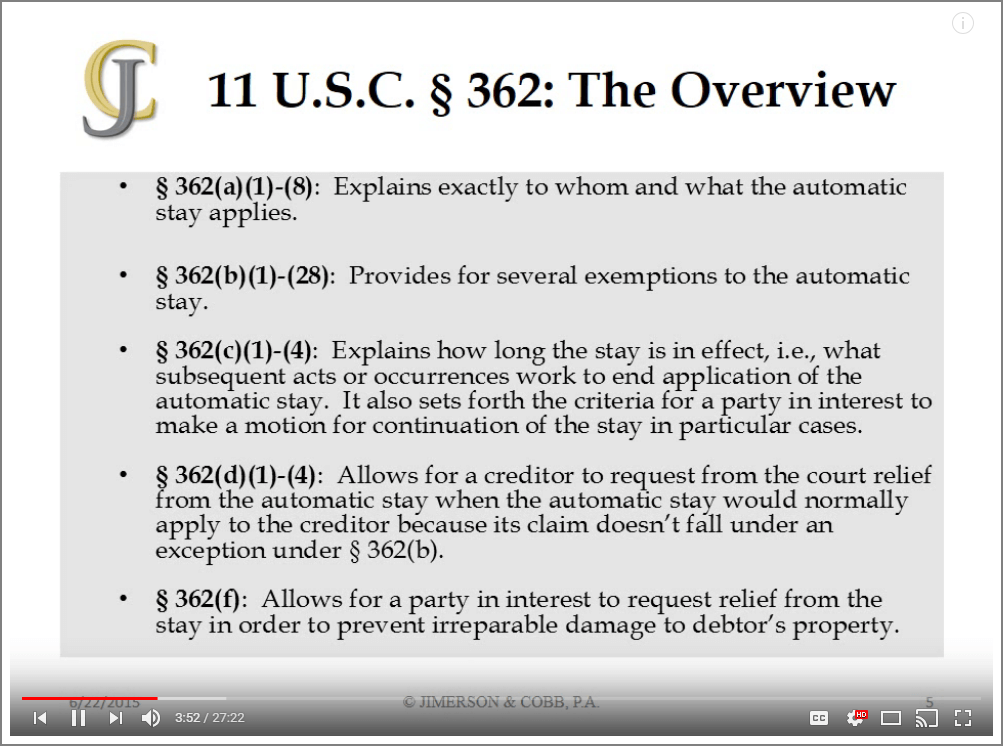

What happens when a debtor is granted an automatic stay in bankruptcy court? Essentially, it halts creditors and potential creditors from trying to collect pre-bankruptcy debts. However, there are exceptions which may be relevant to your case. This video presentation explains the automatic stay as set forth in the U.S. […]