Handling Delinquent Customers: Legal Action and Collection Methods, Part I

Reading Time: 4 minutes

Often times the most challenging part of operating a business is ensuring you’re getting paid for your efforts. As a business chugs along month after month, it’s inevitable that a stack of past-due accounts receivables eventually grows. This is an unfortunate situation in which even the most business-savvy entrepreneurs find themselves with delinquent customers. Implementing a few best practices into your future customer dealings, agreements and collection methods can help curtail rising accounts receivables.

Written Plan For Addressing Delinquent Accounts

For starters, it is vital that your business implement a written plan for timely addressing delinquent accounts receivables before they get out of hand. Every business should have a formal collection process in place to know the plan of attack on day one of the receivable and to have a consistent approach for all delinquent accounts. The goal should be that no past-due receivables are overlooked and ignored.

A collection policy need not be complicated or burdensome. In fact, the simpler the better. The point of the plan is to avoid procrastination on delinquent accounts and, therefore, to ensure action of some type is taken every so often. For example:

- 10 days past due – phone call to debtor;

- 20 days past due – follow up phone call to debtor;

- 30 days past due – written demand letter to debtor;

- 60 days past due – final notice demand letter to debtor;

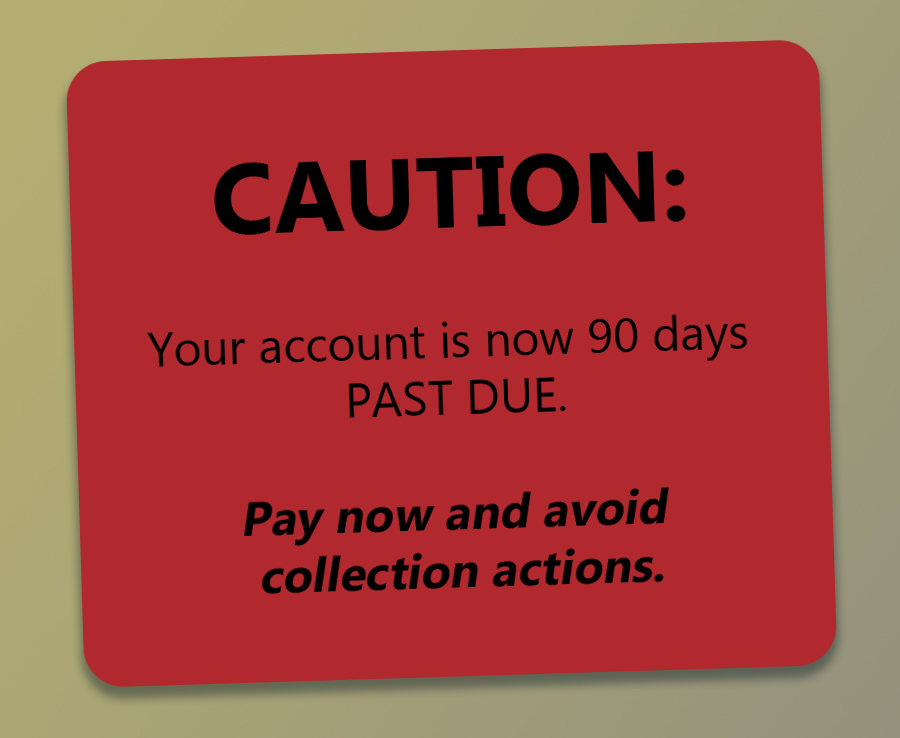

- 90 days past due – turn past-due account over to an attorney.

Important Customer Information For Increasing Collection Success

Once you have a formal written collection plan in place, the next step is to ensure your customer contracts and credit agreements contain the information you need to make it easier on your business to collect the inevitable next delinquent account. When it comes to obtaining customer information, the more the better. This is where the wise old saying – an ounce of prevention is worth a pound of cure – comes to mind. The following is a non-exhaustive list of must-have customer information to request on your documents:

- Full legal name;

- Name of personal guarantor if customer is a business;

- Home address;

- Business address;

- Cell phone number (in addition to business number);

- Email addresses;

- Banking institution with account numbers, banker contact, address and phone number;

- Trade references;

- Personal referrals;

- Disclosure of prior bankruptcy filings.

Additional Considerations For Your Contracts And Agreements

If possible based on your business, obtain a spouse’s signature on your contracts / agreements to include as an additional customer. If the spouse signs as a customer it will make him or her obligated for the debt as well. This helps your business to avoid marital debt protection defenses such as “tenancy-by-the-entireties” for jointly-held assets, including joint bank accounts. Some customers may object to having his or her spouse sign if it is not necessary for the specific goods or services purchased, and this is not worth losing a customer over. However, you may be surprised at how many comply.

Don’t forget about the personal guarantee. If your customer is a corporation or other business entity you must have a personal guarantee section on your contract or credit agreement. The individual signing as the personal guarantor must sign in his or her individual capacity, not in his or her corporate capacity. Bottom line is that your business needs an individual that it can collect the debt from if the business entity goes out of business or has other financial difficulties.

Regarding interest and collection costs, you will want to ensure your contracts give your business the right to collect interest at the highest rate allowed by law. Your business should also consider including an attorney’s fees provision on its agreements. In Florida you are able to claim recovery of your collection costs and attorney’s fees so long as the underlying contract gives you the right to do so.

Be aware that this type of provision works both ways. If you can claim prevailing party attorney’s fees from your customer, then your customer will be able to do the same against your business in the event the customer is the prevailing party. The reality is that for many businesses, without the ability to recover collection costs and attorney’s fees some debts just won’t be worth pursuing, which hurts the bottom line over time. Stayed turned for part II in this blog series.